As a small business owner, you know your company inside and out. You understand its daily operations, know your customers, and have developed systems that work. But have you ever wondered what drives business value and why private equity firms and professional investors can often dramatically increase the worth of businesses similar to yours in just a few years?

The answer lies in understanding and optimizing certain fundamental business value metrics. While you might be excellent at running your business's daily operations, these key value drivers for SMBs could reveal untapped potential for growth and value creation.

The Six Essential Value Indicators

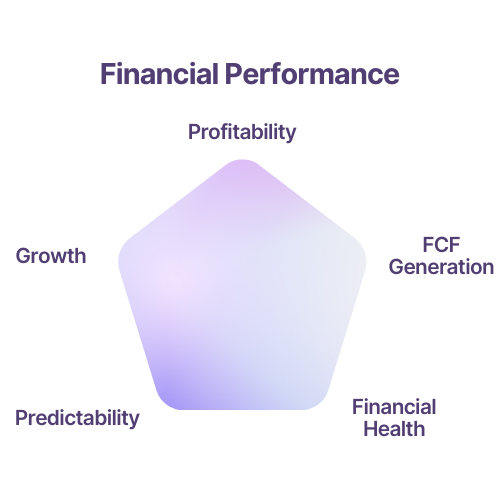

1. Financial Performance

Beyond just revenue or profit, this business performance indicator encompasses how efficiently your company generates and uses cash. It considers key factors that drive sustainable growth:

- Profitability sustainability and trends over time

- Cash flow generation patterns and working capital efficiency

- Overall financial health and stability metrics

- Investment decisions and capital allocation effectiveness

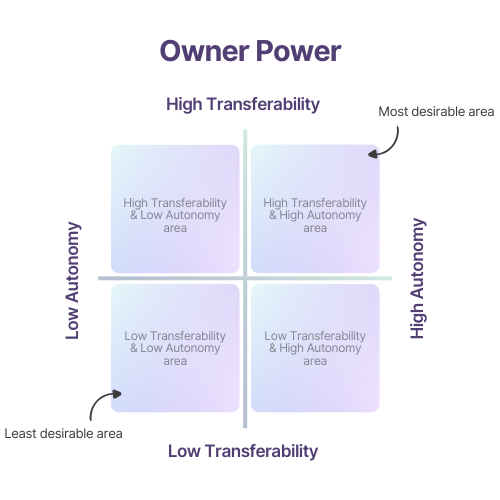

2. Owner Power

How dependent is your business on you? While your expertise is valuable, a business that can operate smoothly without the owner's constant presence is generally worth more. This measures:

- Operational autonomy and system effectiveness

- Knowledge transferability across the organization

- Management structure effectiveness and depth

- Documentation and process standardization

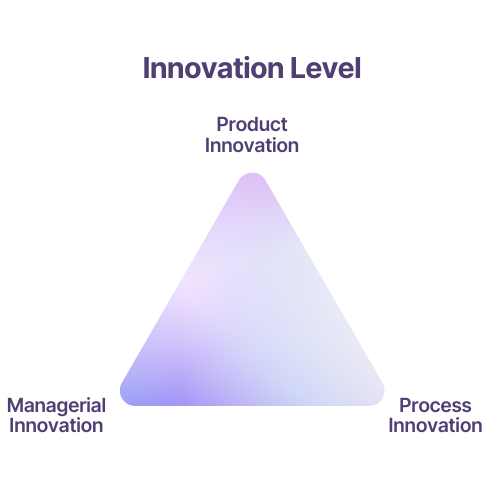

3. Innovation Level

Innovation isn't just about creating new products. This value maximization metric measures your business's ability to adapt and improve across multiple dimensions:

- Continuous improvement of existing offerings

- Process optimization and efficiency gains

- Management practice adaptation and evolution

- Market responsiveness and adaptation capability

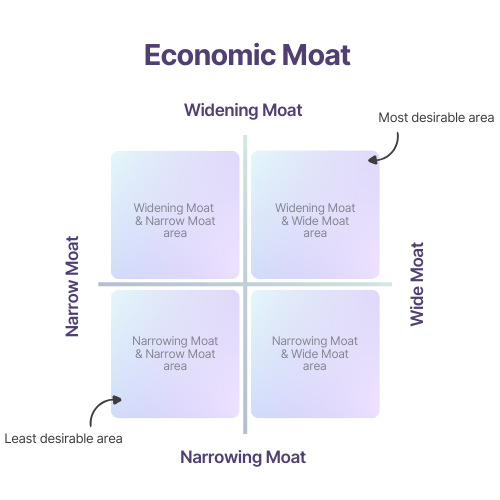

4. Economic Moat

Warren Buffett popularized this term, which describes your business's competitive advantages that protect profits from competition. Key aspects include:

- Market position strength and defensibility

- Pricing power and margin sustainability

- Barrier to entry effectiveness

- Brand strength and market recognition

5. Customer Quality

Not all customers are created equal. This factor examines:

- Customer retention rates and lifetime value

- Revenue predictability and stability

- Marketing efficiency and acquisition costs

- Customer concentration and diversification

6. Business Risk

Professional investors carefully evaluate various risk factors that could impact business value:

- Financial accuracy and reporting quality

- Organizational stability and succession planning

- Market position sustainability

- Regulatory and compliance considerations

Why These Indicators Matter

Understanding these key performance indicators for business value is crucial because they:

- Help you identify areas where your business could improve and grow

- Guide strategic decision-making and resource allocation

- Indicate how valuable your business might be to potential buyers

- Show you where to focus your efforts for maximum impact

The Path Forward

While these business value drivers might seem complex, you don't need to tackle everything at once. Start by conducting a value driver assessment of where your business stands in each area. Look for the biggest gaps between your current performance and potential. Focus on improvements that could have the most significant impact on your business's long-term value.

Remember, working "on" your business rather than just "in" it is crucial for building lasting value. Professional investors succeed because they understand these fundamental drivers of business value and systematically work to improve them.

Ready to Increase Your Business Value?

Get a detailed analysis of your company across all six key value drivers with our free 15-minute assessment.

Take Your Free AssessmentComplete your assessment to get our 130+ page comprehensive report that provides detailed insights and actionable recommendations to increase your company's value across all six indicators.

Start Your Free Assessment →